I have a house that has been rented to some really good tenants the last few years. Sadly, they have decided to move on and I’m now stuck with a dilemma. Should I keep it and lease it to someone else or sell it and re-invest in something bigger?

To me cash flow is one of the best and safest ways to go. A steady cash flow will slowly but surely help you grow your economy. Selling something that provides you with a cash flow to collect a profit isn’t always a good way to go. But, if you can use the profits to re-invest in something that could give you an even bigger cash flow then it’s a different story.

If I get the price I’m hoping for on this house I will free up a lot of capital that can then be used for re-investments. So, is it a good time to sell?

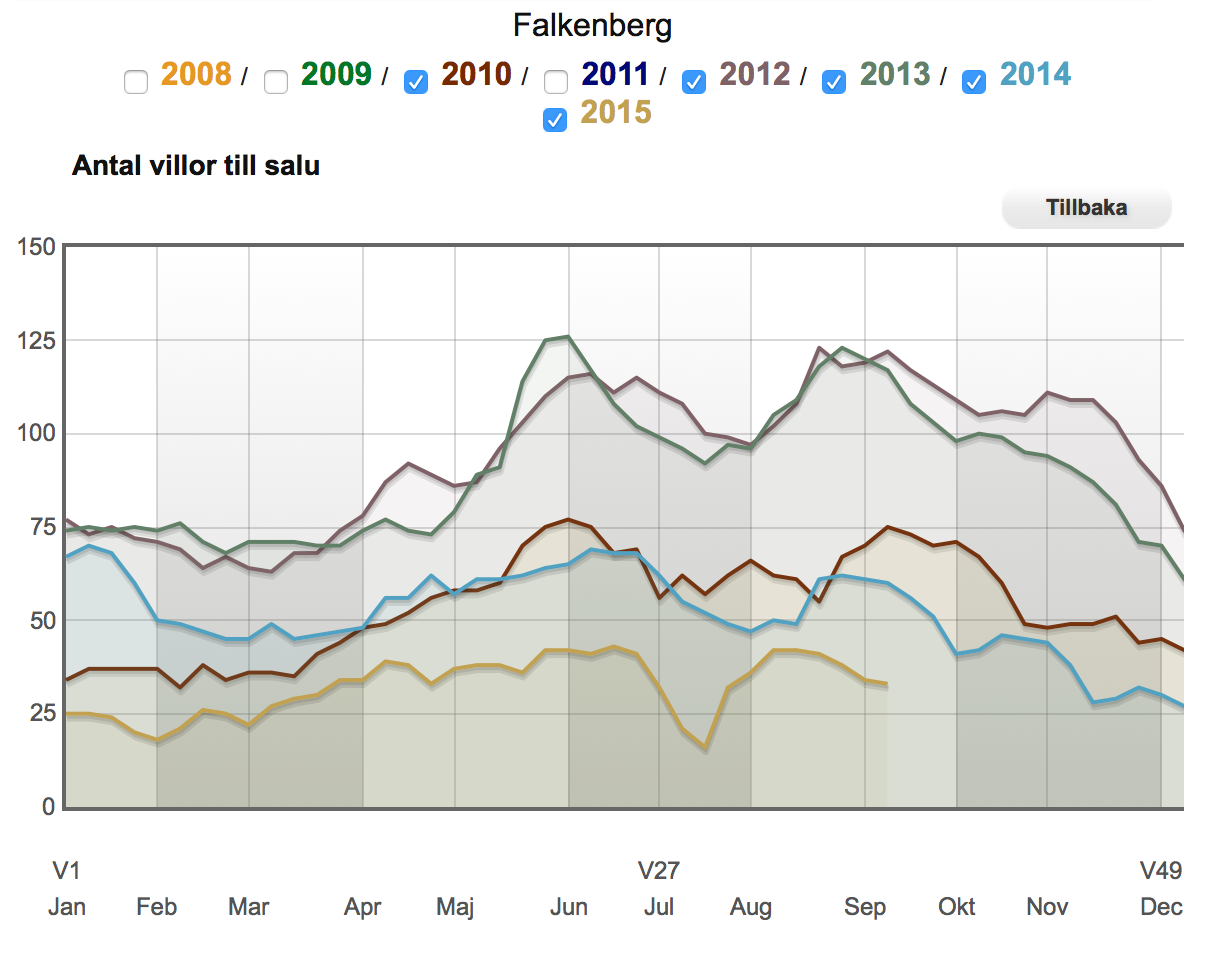

Well. I think so. The graph above shows the amount of houses for sale in the town where my place is located. If you look closely you will see that there is considerable less houses for sale this year than the ones prior.

So, supply is low. How about the demand?

Interest rates are still low and there are a lot of people moving in. These factors make for a pretty good demand.

Conclusion? Relatively high demand and a small supply should make it a decent time to sell? I think I’ll go for it. Will keep you updated.

ps. I suppose that part of doing all this is my love for deals. I know cash flow works magic for anyone wanting to build a passive income, but I find it so much more fun to buy, develop and sell real estate so as long as that works out it will very likely be what I keep doing?

DET BLIR NOG EN BRA AFFÄR :)